Employer of Record (EOR) services have shifted from a niche HR workaround to a mainstream global hiring solution.

A few years ago, EORs were mostly used by startups testing new markets. Today, they’re used by mid-sized firms, venture-backed scaleups, and large enterprises to hire employees in countries where they don’t have legal entities.

That shift is happening for a reason. Remote work is now normalized, global talent competition is intense, and employment regulations are becoming stricter across many jurisdictions. Hiring internationally is easier operationally than ever, but more complex legally.

This article brings together 75 verified Employer of Record statistics to show what’s really happening in the market.

You’ll see how big the EOR market is, how fast it’s growing, how companies are using EORs in practice, and what the real cost and compliance trade-offs look like.

All data points are drawn from market research firms, regulatory sources, vendor disclosures, procurement trends, and industry surveys.

If you’re evaluating EOR providers, planning international expansion, or tracking global HR trends, these numbers provide a grounded view of where the market stands in 2026.

Key Employer of Record (EOR) Statistics

- The global EOR market was valued at approximately US$5.2 billion in 2023

- The market is projected to reach approximately US$7.45 billion in 2026

- Long-term forecasts project US$15.89 billion by 2035 (9.24% CAGR)

- 35% of companies hiring internationally use EORs

- 47% of mid-sized firms use EORs for remote teams or payroll

- Typical EOR onboarding takes 7–21 days

- Entity setup in a new country typically takes 3–9 months

- Monthly EOR service fees range from US$199–$650 per employee

- The entity vs EOR cost crossover appears around 20–25 employees in one country

- North America accounts for roughly 35–45% of global EOR demand

- Europe represents ~25–30% of EOR market share

- Asia-Pacific is the fastest-growing region for EOR adoption

EOR Market Size & Growth

The EOR market is growing quickly, but how big it is depends on how researchers define it.

Some include only platform-based EOR providers. Others include compliance-heavy services and adjacent payroll outsourcing.

That’s why market estimates vary. But across sources, the direction is consistent: sustained growth.

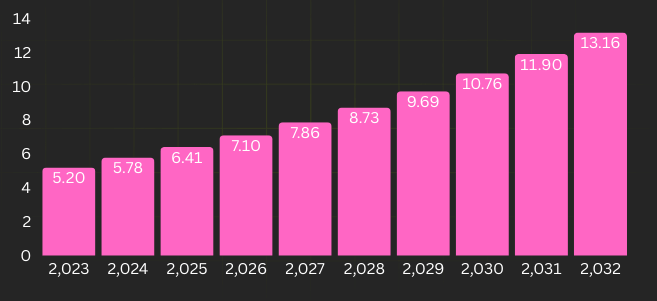

The global EOR market was valued at approximately US$5.2 billion in 2023 and projected to be US$13.1 billion by 2032.

This figure focuses on modern, tech-enabled EOR platforms. It excludes traditional PEOs and legal-heavy service firms.

In practical terms, this represents the “core” EOR model most companies think of today: a platform that lets you hire abroad without setting up an entity.

That matters because it shows EOR is already a multi-billion-dollar category. It’s not experimental or fringe anymore.

It also suggests meaningful buyer demand already exists, even before the next growth wave.

EOR Market Size (US$ billion)

Source: DataIntelo Report

Market forecasts place the global EOR market at approximately US$6.82 billion in 2025.

This implies roughly 31% growth from the 2023 baseline.

Much of this growth is tied to mid-sized companies entering new markets for the first time. These firms often lack local entities and internal compliance expertise.

It also reflects increased awareness. Five years ago, many HR leaders didn’t know EOR was an option. Today it’s commonly included in expansion planning.

In short, growth is coming from both new users and broader recognition.

The same long-range forecast projects the EOR market will reach approximately US$7.45 billion in 2026.

Here, growth moderates to around 9.2%.

That slowdown doesn’t signal weakness. It signals a transition from surge growth to steady expansion. Many early adopters entered during the remote work boom. Now the market is broadening into more traditional industries.

This pattern is typical when a category moves from “hot” to “established.”

Long-range forecasts project the EOR market will reach approximately US$15.89 billion by 2035, representing a CAGR of 9.24% (2026–2035).

A near-10% CAGR over a decade is strong for an HR services market.

This assumes continued globalization of knowledge work and rising regulatory complexity across jurisdictions.

It also reflects workforce expectations for flexibility and location independence. Unless governments reverse remote-friendly policies at scale, these drivers are likely to persist.

Verified Market Research estimates the EOR market at US$4.42 billion in 2024, with a projection of US$8.59 billion by 2032 (6.8% CAGR).

This estimate is more conservative than others.

It likely counts only pure-play EOR providers and excludes adjacent services. The lower CAGR also reflects expectations of competition and margin pressure as more vendors enter.

Still, even conservative forecasts show steady expansion, not stagnation.

Source: Verified Market Research

DataIntelo values the platform-only EOR market at US$4.5 billion in 2023, projecting US$11.8 billion by 2032 (11.1% CAGR).

This forecast isolates the software and orchestration layer. Platform models scale differently. They can expand across countries without matching headcount growth.

That creates software-like economics and attracts higher valuations. It also explains why many EORs are investing heavily in tech infrastructure.

CAGR Comparison Across Research Providers

| Research Provider | Scope Focus | Projected CAGR |

|---|---|---|

| Verified Market Research | Pure-play EOR | 6.8% |

| Cognitive Market Research | Narrow/enterprise focus | 5.48% |

| DataIntelo | Platform-only | 11.1% |

| Industry Range | Mixed definitions | 6–11% |

Several paid reports indicate the market will be worth at least US$8–10B by 2030.

That implies near doubling within six years. The lower bound assumes some firms move from EOR to owned entities.

The upper bound assumes flexibility keeps EOR attractive even at scale. Either way, forecasts point upward.

Top EOR vendors advertise coverage in 100–160+ countries.

That level of coverage requires deep local partnerships and compliance monitoring. Maintaining this footprint is operationally intensive. The fact that multiple vendors can offer it shows infrastructure maturity.

Global coverage is becoming table stakes.

Industry commentary notes increased M&A and funding since 2020.

Large funding rounds and acquisitions signal investor confidence. Capital is flowing into payroll, compliance, and global HR tech. Investors typically fund markets they see as durable, not cyclical.

This suggests belief in long-term demand.

EOR Adoption & Use

EOR adoption has shifted from early adopters to mainstream buyers.

What started with tech startups hiring a few remote workers has expanded into structured global hiring strategies across industries.

These statistics show who is using EORs, how they’re using them, and what that says about where the market is headed.

By 2024, approximately 35% of companies hiring internationally use EORs.

This number refers specifically to organizations doing cross-border hiring, not all companies overall. So within the true “addressable market” for EORs, more than one in three already use the model.

That’s a surprisingly high penetration for a service that was barely known outside HR circles a few years ago. It suggests EORs are becoming a default option for international hiring, not a niche workaround. It also signals that awareness and trust in the model have reached mainstream levels.

About 47% of mid-sized firms use EORs to manage remote teams or payroll.

Mid-market firms (roughly 100–1,000 employees) are the sweet spot for EORs. They’re big enough to hire globally but not big enough to maintain legal entities everywhere.

Unlike large enterprises, they often lack in-house global HR and legal teams. Unlike very small firms, they have consistent hiring volume. That makes EORs a practical middle-ground solution for scaling internationally.

SMEs and startups account for a large share of new EOR contracts.

For startups, speed matters more than perfect cost efficiency. Hiring a key engineer in two weeks via an EOR can be more valuable than saving money through entity setup.

Entity formation can take months, which early-stage firms often can’t afford. For venture-backed companies, speed-to-hire can directly affect growth and valuation. That makes EORs a strategic enabler, not just an administrative tool.

Large enterprises use EORs selectively rather than as a full replacement for entities.

Enterprises rarely rely on EORs as their primary model. Instead, they use them tactically. Common scenarios include testing new markets, hiring niche talent in new countries, or managing short-term projects.

They also use EORs during acquisition transitions or market-entry pilots. For them, EORs are a flexibility tool, not a permanent structure.

EOR Adoption Patterns by Company Size

| Company Size | Typical EOR Usage Pattern |

|---|---|

| Startups | Fast international hiring without entities |

| SMEs | Core international hiring strategy |

| Mid-sized firms | Ongoing multi-country hiring |

| Enterprises | Pilots, niche hires, transition periods |

The entity vs EOR cost crossover typically appears around 20–25 FTEs in one country.

Below this threshold, EOR is usually cheaper and faster. Above it, entity formation can become more economical on a pure cost basis.

But cost isn’t the only factor.

Many companies stay with EORs past this point for flexibility, risk transfer, and simplicity. So the crossover is a guideline, not a rule.

Over 800 firms globally offer some form of EOR/PEO/GEO services.

This includes global platforms, regional specialists, legacy PEOs, and payroll firms. Not all offer the same depth of compliance or coverage.

But the number itself shows how crowded the market has become. High vendor count usually signals strong demand and low entry barriers. It also makes vendor evaluation more important for buyers.

Procurement teams now request SOC 2, ISO 27001, and legal documentation before contracting.

Early EOR buyers often chose vendors based on price and speed. Now procurement processes look more like enterprise SaaS evaluations.

Security certifications, legal opinions, and insurance coverage are standard requests. This reflects higher stakes and higher deal sizes.

It also shows buyers see EORs as critical infrastructure, not experimental tools.

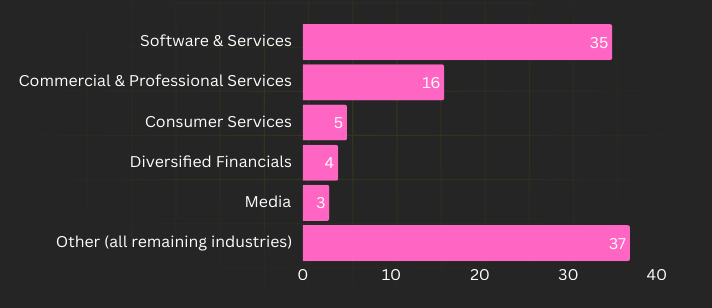

Adoption is strongest in tech, SaaS, fintech, and creative services.

These sectors rely on digital work that can be done from anywhere. They also face intense talent shortages locally.

Global hiring expands the talent pool dramatically. For example, a role that has 10 viable local candidates may have 100 globally.

That math pushes remote-first industries toward EOR solutions.

New hires by industry

| Industry | Percent of new hires (2024) |

|---|---|

| Software & Services | 35% |

| Commercial & Professional Services | 16% |

| Consumer Services | 5% |

| Diversified Financials | 4% |

| Media | 3% |

| Other (all remaining industries) | 37% |

EOR Market Size (US$ billion)

EOR usage spans contractor conversions, first hires, short projects, and sensitive jurisdictions.

Many firms start using EORs when converting contractors to employees. This often happens after legal advice or regulatory warnings.

EORs are also used for first hires in a new country where demand is uncertain. Short-term projects are another common driver.

In complex jurisdictions, EORs act as a compliance shortcut.

Many companies use EORs as part of a phased expansion strategy.

A typical path looks like this:

Year 1: Hire via EOR

Year 2: Assess traction

Year 3: Incorporate if justified

This “test before you commit” model reduces risk. It allows companies to validate markets before investing in entities. For many, EORs function as a market-entry tool.

EOR adoption spikes when regulatory enforcement increases.

Regulatory crackdowns often trigger sudden demand. When misclassification fines hit headlines, companies react quickly.

Many shift from contractors to compliant employment models. EORs provide a fast solution. This creates demand waves tied to enforcement cycles.

Cross-border job postings and remote roles increased 2–3× in some markets since 2020.

Job board data acts as a leading indicator. When cross-border hiring rises, EOR demand usually follows. The remote work boom normalized international teams.

What was once unusual is now routine. That structural shift underpins long-term EOR growth.

EORs increasingly partner with payroll and benefits providers.

Bundling services reduces vendor sprawl for clients. Instead of managing 4–6 providers, companies manage one.

It also increases switching costs and customer stickiness. For vendors, this creates more predictable revenue. For buyers, it simplifies operations.

More EOR customers now request audit rights and remediation SLAs.

This reflects higher buyer sophistication. Companies want visibility into compliance processes. They also want guarantees if something goes wrong.

Audit rights were rare a few years ago. Now they’re increasingly standard in enterprise deals.

Remote Work & Global Hiring Trends

The rise of EORs closely follows the rise of remote and cross-border work.

As companies hire beyond their home country, employment complexity rises. That’s where EORs come in. These data points show how global hiring patterns are shifting.

The World Economic Forum’s Future of Jobs reporting indicates large employer interest in global talent sourcing, with many employers planning to expand remote hiring.

WEF surveys are useful because they capture employer intentions, not just past behavior.

When major employers signal future remote hiring expansion, it suggests sustained demand for cross-border employment models.

Global talent sourcing is increasingly seen as a competitive advantage, not just a cost strategy. This mindset shift directly supports long-term EOR demand.

Approximately 40–60% of knowledge workers now operate under some remote or hybrid model.

This range appears across multiple workforce surveys. Even the low end (40%) represents a structural change from pre-2020 norms.

Hybrid work makes cross-border employment operationally feasible for many roles. Once location matters less, companies naturally widen their talent search.

That widening creates more scenarios where EORs are needed.

Remote job listings in major tech markets saw 2–3× growth since 2019–2020.

Job listing data acts as a leading indicator for hiring behavior. A 2–3× increase shows remote roles are no longer occasional exceptions.

When remote roles grow, cross-border hires usually follow. More cross-border hiring means more compliance complexity.

That complexity is exactly what EORs are designed to handle.

OECD and national tax authorities have updated guidance acknowledging cross-border remote work and its tax/treaty implications.

Updated guidance brings clarity, but also responsibility. Companies can no longer claim uncertainty around remote tax obligations.

Clearer rules often mean stricter enforcement. As obligations become better defined, compliance mistakes become riskier.

This increases the appeal of specialized EOR providers.

The ILO reports hundreds of millions of international migrant workers and maintains datasets on cross-border labor flows.

ILO data highlights the sheer scale of cross-border work globally. While not all migrant workers are remote employees, the data confirms labor mobility is large and persistent.

Cross-border labor has been a long-term trend, not a temporary spike. EORs effectively modernize how companies engage global workers.

This creates a long runway for EOR relevance.

Geographic Hiring Patterns

| Region | Key Hiring Drivers |

|---|---|

| LATAM | Time zone alignment + cost |

| Eastern Europe | Skills + EU access |

| Southeast Asia | Cost + availability |

Hiring platforms report steady increases in employers sourcing talent in LATAM, Eastern Europe, and Southeast Asia.

These regions balance cost and capability. They also offer large English-speaking or multilingual workforces.

Employers increasingly view them as long-term hiring hubs. As sourcing expands geographically, compliance complexity multiplies.

That makes EOR support more valuable.

India, Brazil, Philippines, and Poland are top hiring destinations for global customers.

These countries repeatedly appear in global hiring data. They offer strong technical and professional talent pools.

They also have established outsourcing and remote work cultures. For many firms, these countries are default starting points for global hiring.

EORs often act as the entry gateway into these markets.

By 2025, many tech firms reported 30–40% of engineering headcount being remote or distributed.

That level of distribution would have been rare a decade ago. Engineering teams are now routinely spread across multiple countries.

Managing compliance across those jurisdictions is complex. EORs simplify that management. Distributed engineering is a major EOR demand driver.

Employer demand for near-shore teams in LATAM grew strongly from 2022–2025, driven by U.S. firms seeking timezone-aligned talent.

Time zone alignment enables real-time collaboration. That’s a major advantage over far-off offshore models.

Nearshoring blends cost savings with operational ease. As U.S. firms expand in LATAM, compliant hiring becomes critical.

EORs often enable that expansion.

Surveys show 60–80% of workers would consider accepting cross-border remote jobs, up from 20–30% in 2019.

This is a major mindset shift among workers. International remote employment is now normalized. A larger willing workforce makes global hiring easier for employers.

That, in turn, expands the EOR addressable market. Worker openness fuels employer action.

Global talent platforms report 5–10× growth in employer activity for cross-border hiring from 2020 to 2024.

A 5–10× increase is dramatic. It signals not just growth, but a structural shift. Employer demand for international talent is accelerating.

Each cross-border hire introduces compliance considerations. That keeps EORs highly relevant.

Many companies now include “global hiring” as a standard go-to-market capability in growth plans.

Global hiring is becoming part of standard expansion playbooks. It’s discussed alongside marketing and sales strategy.

When global hiring is planned from day one, EORs often enter early. This embeds EORs into company growth strategies.

Not just reactive hiring.

Regional regulatory complexity increases the appeal of EORs as a compliance shortcut to rapid hiring.

The EU alone has 27 member states with distinct labor rules. APAC markets vary widely in employment law.

DIY compliance across these regions is resource-heavy. EORs package this complexity into a service. That convenience has real value for fast-growing firms.

Companies with remote-first policies are 4–5× more likely to hire internationally.

Remote-first policies remove geographic hiring constraints. Once location restrictions drop, talent pools expand.

International hiring naturally follows. Each international hire increases compliance exposure. EORs help manage that exposure.

Compliance & Risk

Compliance risk is one of the biggest drivers of EOR adoption.

Many companies first consider EORs after a legal scare, an audit, or a misclassification warning. These statistics show how enforcement trends and regulatory coordination are reshaping global hiring decisions.

Spain fined Glovo €78 million for rider misclassification (2018–2021), accelerating compliant hiring reviews across Europe.

This case is widely viewed as a turning point in European platform regulation. The €78 million fine related to 10,600 misclassified riders and sent a strong message to gig and platform companies.

It showed that misclassification penalties can reach tens of millions of euros, not just minor fines. After this ruling, many firms operating in Spain and neighboring EU markets reviewed their contractor models.

For many, switching to EOR-based employment became a fast path to compliance.

Source: Reuters

Reuters reports Delivery Hero/Glovo faced follow-up enforcement; large fines prompted vendor strategy changes.

Delivery Hero disclosed provisions exceeding €200 million for potential liabilities. That level of financial exposure can materially affect company earnings and investor confidence.

When companies start reserving hundreds of millions for compliance risk, boards take notice. These cases pushed firms to rethink independent contractor-heavy models.

EORs emerged as one structured alternative for compliant employment.

Labour, tax, and data authorities increasingly coordinate audits, creating multi-vector exposure.

Enforcement today is rarely isolated. A payroll issue can trigger labor inspections, tax reviews, and data protection scrutiny at the same time.

This coordination multiplies risk from a single mistake. What might once have been a manageable penalty can escalate quickly.

This environment increases the perceived value of specialized compliance partners like EORs.

ILO reports on cross-border employment flows underpin enforcement risk when companies misclassify workers.

Large cross-border labor flows attract regulatory attention. Governments want proper tax collection and worker protections.

When cross-border hiring grows, so does scrutiny. Misclassification becomes easier to detect in structured labor markets.

EORs help align employment structures with local rules.

Data-protection enforcement peaked in high-profile GDPR fines, underscoring payroll data risks.

Payroll systems contain some of the most sensitive employee data. That includes national IDs, bank details, and compensation records.

GDPR fines have reached hundreds of millions in some cases. A payroll data breach can become both a legal and reputational crisis.

EORs that invest in data security and certifications become more attractive partners.

Spain, Italy, France, and LATAM increased audits of platform and cross-border work practices since 2020.

These jurisdictions are known for active labor enforcement. Companies operating there face higher audit probability.

This doesn’t mean non-compliance elsewhere is safe. It means certain regions act as early enforcement leaders.

Firms often adopt stricter global compliance standards after facing audits in these markets.

Companies using EORs transfer operational compliance but strategic responsibility (PE risk) remains with clients.

EORs handle payroll and employment classification. But permanent establishment (PE) risk depends on business activities.

If employees sign contracts or make strategic decisions, PE exposure can still arise. Some buyers misunderstand this distinction.

Sophisticated companies use EORs alongside tax and legal planning.

Coordinated enforcement raises stakes for multinational hiring missteps, increasing value of reputable EOR partners.

When multiple agencies act together, penalties can stack. Labor fines, tax liabilities, and data penalties may all apply.

This creates risk far beyond a single violation. As a result, vendor credibility matters more. Buyers increasingly prioritize established EORs with strong compliance records.

High-profile tax cases demonstrate corporate tax risk can exceed payroll fines by orders of magnitude.

The example of Kering’s €1B+ Italian tax settlement illustrates scale. Tax exposure can dwarf employment penalties.

For multinational firms, tax risk often worries CFOs more than HR leaders. This shifts EOR decisions into finance and legal discussions.

Premium compliance services start to look economically rational.

Industry counsel recommend requesting local tax registrations, PE opinions, and audit reports from EOR vendors.

Due diligence has become more structured. Buyers now ask for proof of local entity registration and tax compliance.

Legal opinions and audit documentation are increasingly standard. This mirrors enterprise SaaS vendor vetting.

It also reflects higher stakes in global employment.

EORs reduce misclassification risk but don’t remove PE exposures if staff bind contracts or generate revenue.

Here’s a deeper, article-ready expansion you can plug into your compliance section. It keeps a neutral, research-backed tone and ties the point to real-world practice and market behavior.

Why EORs Reduce Misclassification Risk — But Not Permanent Establishment (PE) Risk

Using an Employer of Record meaningfully lowers worker misclassification risk, but it does not automatically eliminate permanent establishment (PE) exposure. Those are two different legal issues, and they’re assessed by different authorities under different rules.

1) What EORs do solve well: misclassification

Misclassification happens when a worker is treated as an independent contractor even though, legally, they function as an employee.

EORs address this by:

- Hiring workers as formal employees under local labor law

- Running compliant payroll and tax withholding

- Providing statutory benefits

- Issuing locally compliant employment contracts

In markets with active enforcement, this matters. High-profile cases in Europe and Latin America have shown that misclassification penalties can reach tens of millions of euros and trigger back payments for taxes and social contributions. That’s one reason many companies move from contractor-heavy models to EOR-based employment.

From a risk perspective, EORs shift day-to-day employment compliance to a specialist that understands local rules. That alone removes a large portion of common cross-border hiring mistakes.

But misclassification is only one side of the equation.

2) What EORs don’t automatically solve: PE exposure

Permanent establishment (PE) is a corporate tax concept, not an employment classification concept.

A PE can be created when a company is seen as having a taxable business presence in a country. This can happen even if workers are legally employed by an EOR.

Common PE triggers in tax treaties and OECD-style frameworks include:

- Staff who habitually conclude or negotiate contracts on behalf of the foreign company

- Employees who generate revenue locally, especially in sales roles

- A fixed place of business used regularly for company activities

- Senior staff making strategic or management decisions in-country

If any of these apply, tax authorities may argue that the foreign company has a taxable presence.

EOR Operational & Cost Benchmarks

For many companies, the EOR decision is ultimately operational and financial. Speed, cost, and internal workload often matter as much as compliance.

These benchmarks show how EOR compares to entity setup in real-world scenarios.

Typical EOR onboarding time is 7–21 days, enabling hires far faster than entity formation.

This timeline usually includes contract execution, background checks, local contract generation, and payroll setup.

For companies hiring critical roles, shaving months off hiring time can have real business impact. A delayed hire can slow product launches, market entry, or customer delivery.

EORs compress what would normally be a multi-month setup into weeks. That speed is one of the model’s biggest selling points.

Source: HRStacks

Typical entity setup time for a new country is 3–9 months, depending on local requirements.

Entity formation involves registration, tax setup, banking, and payroll infrastructure. Each step may require government approvals and local advisors.

In some jurisdictions, banking alone can take several months. For fast-moving companies, this delay can be impractical.

That’s why entities are often reserved for longer-term commitments.

EOR vs Entity Formation Timeline

| Step | EOR | Entity Setup |

|---|---|---|

| Legal setup | Not required | 4–8 weeks |

| Tax registration | Included | 2–4 weeks |

| Banking | Not required | 4–12 weeks |

| Payroll setup | 1–3 days | 2–4 weeks |

| Total | 7–21 days | 3–9 months |

Average EOR setup fees: US$0–$2,000 (enterprise deals often waive fees).

Setup fees vary by vendor and deal size. Lower-cost providers may charge little to nothing upfront. Premium providers may charge higher setup fees but bundle more services.

Large enterprise contracts often negotiate these fees away entirely. So setup cost is rarely the deciding factor in vendor selection.

Monthly EOR service fees: US$199–$650 per employee, depending on country and benefits.

Fees vary by labor cost, compliance complexity, and benefits requirements. Higher-cost countries often sit at the upper end of the range.

Volume discounts commonly apply at 10+, 50+, or 100+ employees. This predictable per-employee pricing helps budgeting.

But it can add up at scale, which is why crossover points matter.

Read our Global EOR Price Index Report

Entity formation cost: US$15,000–$100,000+ depending on jurisdiction.

Costs include legal, tax, accounting, and HR infrastructure. Simpler markets may fall in the US$15,000–30,000 range.

More complex jurisdictions can exceed US$50,000–100,000. These figures exclude ongoing maintenance costs.

That makes entity setup a significant upfront investment.

Cost Comparison (First Year, 10 Employees)

| Cost Type | EOR | Entity |

|---|---|---|

| Setup | $0–$2,000 | $15,000–$100,000+ |

| Ongoing admin | Included | Legal + accounting fees |

| Payroll & compliance | Included | Separate vendors |

| Speed to hire | 7–21 days | 3–9 months |

Buyer surveys report 30–50% reductions in HR administrative effort when using EORs.

Managing multi-country payroll and compliance is time-intensive. EORs centralize that work.

Savings often translate to 15–25 hours per month per country. For multi-country operations, that adds up quickly.

Reduced admin burden frees HR for strategic work.

Entity crossover typically appears around 20–25 employees in a single market.

At around 20 employees, annual EOR fees can approach entity costs. At 30+ employees, entity economics may look better.

However, cost isn’t the only factor. Flexibility, risk transfer, and exit simplicity still matter. That’s why some firms stay on EORs beyond the crossover.

EORs offer bundled payroll, benefits, and statutory filings.

Without EOR, companies must manage multiple vendors. This can include payroll firms, benefits brokers, and legal advisors.

Each vendor adds coordination effort. EORs consolidate these relationships. That simplicity is valuable for lean teams.

Companies often use a mix of EORs for speed and entities for scale—a hybrid pattern.

A common model is using EORs in 5–8 markets initially. After 12–18 months, companies incorporate in 2–3 core markets.

They keep EORs in smaller or experimental markets. This balances flexibility and cost efficiency. Hybrid models are becoming the norm for global firms.

Regional & Country Signals

EOR demand isn’t evenly distributed.

It tends to grow fastest where three things intersect:

- Cross-border hiring demand

- Regulatory complexity

- Strong talent supply

These regional signals show where EOR usage is concentrated and where it’s expanding next.

North America (U.S. + Canada) accounts for roughly 35–45% of global EOR demand/revenue.

This makes North America the single largest EOR market. The region drives demand both from companies hiring abroad and from foreign firms hiring into the U.S. and Canada.

High purchasing power and aggressive international expansion by North American firms contribute to this share. English-language dominance also simplifies cross-border coordination.

In short, many global hiring strategies still originate from North America.

Europe represents 25–30% of EOR market share due to regulatory-driven demand.

Europe’s share is strongly tied to labor regulation. The EU alone has 27 member states, each with distinct employment frameworks layered over EU-wide directives.

Employee protections are generally stricter than in many other regions. This raises the cost of mistakes.

As a result, companies often prefer EORs to navigate European compliance.

Asia-Pacific is the fastest-growing region (higher CAGR) for EOR adoption.

APAC growth is driven by startup ecosystems and multinational expansion. Markets like Singapore, India, and Australia are attracting cross-border hiring.

Regulatory frameworks in the region are also maturing. As rules become clearer, enforcement tends to follow.

That combination makes compliant hiring models more attractive.

Global EOR Market Share by Region

| Region | Estimated Global Share (%) | 2024/25 Market Insight | Projected Growth Notes |

|---|---|---|---|

| North America | 35–45% | Largest current market share, strong adoption | Mature adoption, slower CAGR |

| Europe | 25–30% | Strong regulatory-driven demand | Moderate growth |

| Asia-Pacific | 22–24% | Fastest-growing regional share | 17.1% CAGR to 2033 |

| Latin America | 4% | Rising post-2020 nearshoring | Mid-teen growth expected |

| Middle East & Africa | 9% | Smaller share but expanding | Expanding Gulf and African markets |

Asia-Pacific’s share of the global Employer of Record market already rivals that of Europe, and while North America still holds the largest portion, APAC’s growth trajectory is the most aggressive. At an estimated 17.1% compound annual growth rate through 2033, this region is outpacing other geographies and becoming a key battleground for EOR providers.

Two structural factors are driving this:

- Rapid economic and labour market expansion in China, India, Southeast Asia, and Australia, which fuels demand for cross-border talent and remote labor mobility.

- Maturing regulatory environments that both encourage compliant hiring and create complexity that companies prefer to outsource to specialists.

Together, these trends help explain why Asia-Pacific is considered the fastest-growing regional market for EOR adoption, rather than just a growing subset of a mature global market.

Source: Marketgrowthreports

Conclusion

The Employer of Record market is no longer a side option for a few globally ambitious startups. It has become part of how modern companies build international teams.

The numbers tell a clear story. A market valued at approximately US$5.2 billion in 2023 and projected to reach US$7.45 billion in 2026 isn’t just growing; it’s stabilizing into a recognized category.

Looking further ahead, forecasts of US$15.89 billion by 2035 with a 9.24% compound annual growth rate suggest that analysts see durable demand, not a temporary spike driven by remote work hype.

Adoption patterns reinforce that view. When 35% of companies hiring internationally already rely on EORs, and nearly 47% of mid-sized firms use them for remote teams or payroll, it signals that EORs have crossed into the mainstream.

These aren’t edge cases anymore. They’re standard tools in the global hiring playbook, especially for companies that want to move quickly without building entities in every country.

Regulation has also played a major role in shaping demand. High-profile cases like Spain’s €79 million Glovo fine covering the 2018–2021 period and 10,600 misclassified riders reminded companies that misclassification risk isn’t theoretical.

Add to that coordinated audits by labor, tax, and data authorities, and it’s easy to see why compliance has become a board-level issue. For many organizations, EORs are as much about risk management as they are about convenience.

Then there’s the practical math. Hiring through an EOR in 7–21 days looks very different from waiting 3–9 months to set up a local entity.

When monthly service fees of roughly US$199–$650 per employee are weighed against entity setup costs that can range from US$15,000 to US$100,000 or more, the appeal becomes clear, particularly below the typical 20–25 employee crossover point in a single country. Even beyond that threshold, some firms stay with EORs for flexibility and lower administrative burden.

Geographically, demand is both concentrated and spreading. North America’s 35–45% share of global EOR demand and Europe’s 25–30% share show where usage is most mature, often driven by outbound international hiring and strict labor frameworks.

At the same time, Asia-Pacific’s faster growth rates and Latin America’s post-2020 nearshoring surge point to where future momentum may come from.

Taken together, these trends suggest that EORs are evolving into a layer of global business infrastructure. Not every company will rely on them forever, and many will still transition to local entities in their largest markets.

But for testing new countries, hiring small distributed teams, or entering complex jurisdictions, the model fits how companies now operate.

Global hiring isn’t slowing down. Talent is distributed, regulations are tightening, and speed still matters. As long as those three realities hold, Employer of Record services are likely to remain a central part of how companies expand across borders.