I’ve been in too many meetings where HR and finance teams half-joke, half-worry about a contractor who’s a full-time teammate, but officially labeled “freelance.”

The teammate writes code on your GitHub, participates in your retrospectives, mentors juniors, and has slipped into company culture, yet technically isn’t an employee. That mismatch? That’s how unexpected tax bills and compliance headaches sneak in.

Now imagine handling that transition, moving your contractor into a proper payroll setup, without setting up a local office in another country.

Enter the Employer of Record (EOR): the legal middleman who becomes the formal employer, even though you still call the shots day-to-day. They handle taxes, benefits, contracts, all the nitty-gritty, while you keep building the product, not filling paperwork.

In this article, I’ll walk you through how that switch works, from the messy risks of misclassification to the practical steps you’ll follow, plus where things can trip up if you’re not careful.

This is the playbook I’ve seen work when you need to make things official quickly, efficiently, and cleanly, even when dealing with complex issues like borders, currencies, and labor laws.

Key Takeaways

- An EOR simplifies the transition from contractor to full-time by handling payroll, benefits, and compliance in the worker’s country.

- Misclassification risks are real — switching through an EOR ensures legal compliance with local employment laws.

- Costs go beyond salary — factor in benefits, taxes, and onboarding time when making the change.

- Clear communication matters — explain the benefits and changes to the worker early to ensure a smooth transition.

- The process is faster than traditional hiring — with the right EOR, you can often complete the switch within a few days to weeks.

Why Bother Switching from Contractor to Full-Time?

Sometimes a contractor arrangement works fine, until it doesn’t. Switching to full-time through an EOR can bring stability, legal clarity, and benefits that protect both the worker and the company.

Three reasons come up again and again:

Compliance risk is quietly growing: If someone acts like an employee, taking daily direction, long-term assignments, and can’t pick up other clients, that looks employee-ish under U.S. law.

The Department of Labor’s 2024 economic realities test is still legally on the books, but as of May 2025, enforcement has shifted back to older guidance like Fact Sheet #13 and past opinion letters. That means regulators may still use the 2024 factors in private lawsuits, but day-to-day enforcement now leans on the older framework.

Getting it wrong gets expensive fast: Misclassifying can trigger back taxes, FICA responsibilities, penalties, and interest. The IRS’s VCSP offers a gentle landing: reclassify and pay just 10% of what you’d owe; the rest goes away.

The role matters: Getting paid as a sideline is riskier. Contractors who build core IP, lead teams, or run product lines are already living like employees. An EOR lets you make that official without setting up a local legal entity. They handle payroll, benefits, contracts, and you’re the one calling the shots.

Quick Refresher: The Rules Are Not The Same Everywhere

Laws around classifying someone as a contractor or employee shift dramatically depending on where you’re operating. What looks legally sound in one place, like the U.S., might be a red flag in another, such as the U.K., Australia, or parts of Europe, each using different tests or presumptions.

United States

Classification is about the totality of circumstances (not a single bright line). While the DOL’s 2024 rule articulates six core factors for FLSA purposes, the IRS still applies its common-law control framework for tax purposes. If you want to switch proactively, the VCSP is the friendliest on-ramp.

California

The ABC test presumes employee status unless you can show the worker is free from control, performs work outside your usual business, and is independently established. California also puts teeth behind misclassification with separate civil penalties for willful misclassification.

United Kingdom

Off-payroll working (IR35) hinges on whether, for tax purposes, the person would be an employee if engaged directly.

HMRC’s guidance and CEST tool are the best starting points; liability can sit with the client in many cases since the 2021 reforms. If your contractor looks “inside IR35,” it’s a flashing sign to convert.

European Union

The EU’s Platform Work Directive, in force since December 1, 2024, creates a presumption of employment for certain platform arrangements where the company controls pay, schedules, or other key work conditions.

Member states have until the end of 2026 to bring it into local law, so the impact will phase in country by country.

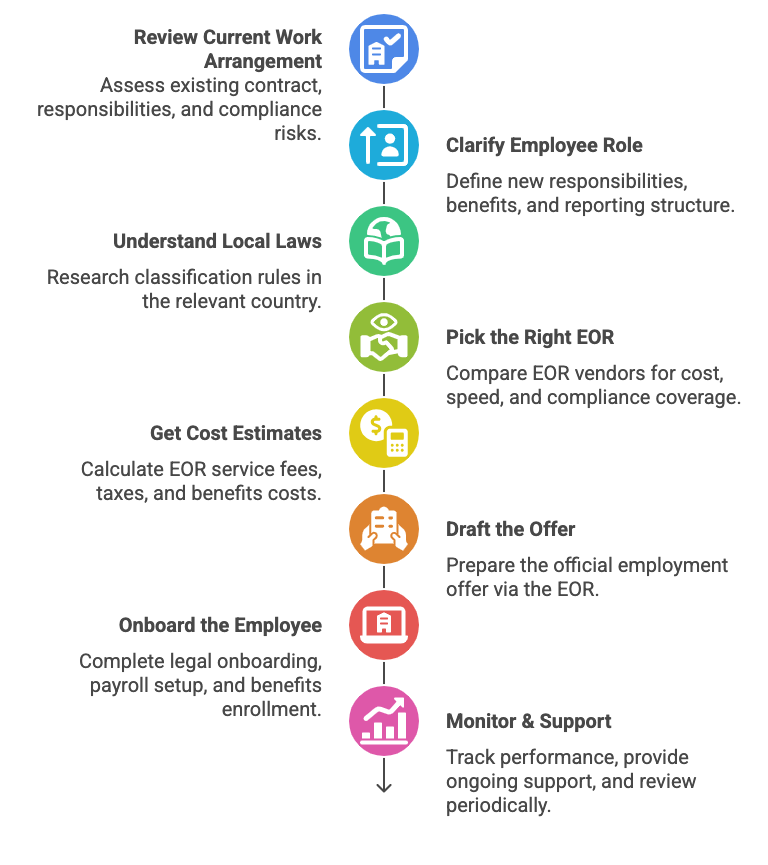

8 Practical Steps to Move from Contractor to Employee via an EOR

A useful roadmap for employers navigating this shift. These steps outline how to cleanly convert a contractor into a full-time employee through an Employer of Record, without losing time or tripping over tangled compliance issues.

Step 1. Do a classification audit

Start by mapping how the contractor actually works day-to-day, who sets their hours, whether they can subcontract, how they bill, and how long they’ve been with you. If you’re in the U.S., map those facts to the DOL’s six-factor lens (and keep a note that WHD enforcement posture evolved in 2025).

In the UK, sanity-check with IR35 criteria or CEST. The goal isn’t to litigate; it’s to justify the business decision to convert.

Step 2. Decide whether to use VCSP (U.S. only) for a cleaner transition

If you’ve had a borderline setup with U.S. contractors, talk to tax counsel about filing Form 8952 for the IRS VCSP before moving those people to W-2. It narrows the federal tax bite for prior periods and reduces audit exposure for worker status in earlier years.

VCSP generally requires that you’ve filed 1099s for the prior three years and that you’re not currently under audit.

Step 3. Pick the EOR, and pressure-test the details

Most EORs support contractor-to-employee conversions, but you’ll want to dig into the fine print. Ask whether their offer matches local norms for paid leave, allowances, and pension. Confirm they include full IP assignment and confidentiality clauses.

Check probation and notice terms, payroll cadence (including 13th-month pay norms), and whether they can handle your equity plan.

Step 4. Build the comp + benefits package using local benchmarks

Don’t assume a $5,000/month contractor in Bogotá translates to a $5,000 gross employee salary, once you add taxes, social contributions, paid leave, and benefits, the net take-home changes significantly.

Your EOR should provide a total-comp model for that country so you can keep take-home pay reasonable while adding benefits and employer costs. (Many EORs share country-by-country benefits explainers; ask for them up front.)

Step 5. Line up the paperwork: contract, policy addenda, and data flows

The EOR will issue a compliant local-language employment agreement. You’ll typically supply role details, salary, benefits, and any extras (stipends, one-time conversion bonus).

Make sure the agreement includes an invention assignment and IP provisions that route ownership to your company; major EORs explicitly address this in their templates.

Step 6. Terminate the contractor agreement

Don’t double-run both relationships. Close out the contractor SOW with a signed acknowledgment that all invoices are paid, all materials are returned, and any prior IP has been assigned (if applicable). Have the EOR employment start the day after the contractor engagement ends to avoid overlap risk.

Step 7. Onboard like a real employee

Yes, the EOR is the legal employer, but culture belongs to you. Give day-one access, set expectations, and make the person visible. On the admin side, the EOR will handle payroll setup, statutory registrations (e.g., PAYE in the UK), and enrollment into local benefits.

Step 8. Keep an eye on immigration edge cases

If your contractor is not a citizen of the country where they live, ask early whether an EOR can sponsor or maintain their work authorization.

Rules vary by country; in some places, the sponsor must be the genuine employer responsible for the work (and “supplying” workers to third parties is tightly controlled), so EOR sponsorship may be limited. Your EOR’s immigration team should give a definitive answer per country.

Transitioning from Contractor to Full-Time Employee

What the Switch Will Really Cost You

Take the contractor’s current net monthly invoice and compare it to a modeled gross employee package.

- Employer costs to add: EOR fee (often a flat monthly per employee fee), employer social contributions, statutory benefits, any supplemental benefits you choose, plus paid leave accrual.

- One-time items: Conversion bonus (to offset perceived “rate cut”), equipment stipend, or a small equity grant if that’s part of your philosophy.

In practice, the total employer cost for a compliant employee may land 15-35% higher than the contractor’s invoice in many markets, depending on the social contribution regime and your benefits choices.

Your EOR’s country calculator should give you a precise figure before you make the offer. (They do this every day; take advantage of it.)

Avoid These Mistakes When Switching to Full-Time via an EOR

Switching a contractor to full-time via an EOR seems neat on paper, but it’s surprisingly easy to trip over local rules, hidden costs, or misaligned expectations. Lucky for you, most of these glitches are avoidable once you know what to look out for, and how to fix them cleanly.

A few traps tend to trip teams up. The first is running the contractor and employee relationships in parallel “just for a month”, it causes confusion and tax risk, so end the contract before starting employment.

Another is skipping local notice or probation norms; these aren’t just formalities, they protect both sides. Equity is another common snag. Yes, you can grant it through an EOR, but you’ll need to plan for local tax and filings.

And remember, an EOR won’t erase permanent establishment risk if the person’s role ties directly to sales or revenue. Finally, in the U.S., tidy up any 1099 history before moving forward; the VCSP program can make that far cheaper.

Inside the EOR Agreement — What You’re Really Signing Up For

At its core, an EOR contract outlines the responsibilities and expectations between your company (the client) and the EOR provider. Here’s what usually shows up, and what you’ll want to review closely:

A solid EOR contract should feel like a safety net, clear, transparent, and tailored to your situation. Expect to see details on your start date, onboarding plan, and how your salary will be structured, including bonuses, allowances, and the currency of payment.

The benefits section will outline everything from healthcare and pension to any locally required perks. Paid leave rules should be spelled out for vacation, sick time, and parental leave.

You’ll also want to review the fine print around termination clauses, intellectual property, confidentiality, and how disputes will be resolved. In today’s compliance-heavy world, data privacy language is non-negotiable.

Finally, the invoicing schedule should make it clear when and how payments happen, so there are no surprises.

A Real-World Timeline That Actually Works

Here’s the sequence I’ve seen land smoothly for global teams:

- Week 0-1: HR + manager gather facts and decide “yes, this is an employee.” Tax counsel checks whether VCSP or a local equivalent makes sense (U.S.).

- Week 1-2: Select EOR after a short bake-off. Send them the contractor’s résumé, role, level, and target start date.

- Week 2-3: EOR returns a country-specific comp model and a draft employment agreement. You negotiate comp, benefits top-ups, and conversion bonus.

- Week 3-4: You present the offer. In parallel, legal prepares a contractor termination letter with IP/return-of-property language.

- Week 4+: Close out the contractor engagement on a Friday. EOR employment starts Monday. Payroll and benefits enrollment happen in that first cycle.

Final Take — Making the Switch Official (and Worth It)

The leap from contractor to full-time employee often feels overdue, like finally giving someone a proper seat at the table. Using an Employer of Record smooths that transition without forcing your company to set up shop in another country.

Sure, it’s not magic, there’s math, paperwork, local quirks, but it gives you a clean, defensible path when someone is already working as if they’re on your team.

There’s something satisfying about the moment a former contractor logs into your tools, sees their name in the org chart, and says, “Feels official.”

It’s a small moment, but it’s why the paperwork and planning are worth it. When done right, the switch isn’t just about compliance, it’s about connection.