Employee misclassification, erroneously labeling employees as independent contractors, is a prevalent issue in today’s dynamic workforce.

Misclassifying workers can strip them of key protections, like minimum wage, overtime pay, and unemployment insurance, while exposing employers to hefty legal and financial risks.

The U.S. Department of Labor emphasizes that misclassified employees may not receive the benefits and protections they are entitled to under the Fair Labor Standards Act (FLSA), leading to potential liabilities for employers.

As businesses expand globally and adopt flexible work arrangements, ensuring proper worker classification becomes increasingly complex. This is where Employers of Record (EORs) play a crucial role.

EORs serve as legal employers on behalf of companies, managing compliance with local labor laws, handling payroll, and ensuring that workers are correctly classified.

By partnering with an EOR, businesses can mitigate the risks associated with misclassification, maintain compliance across jurisdictions, and focus on their core operations without the administrative burdens of employment law complexities.

In this article, we will explore the intricacies of employee misclassification, the consequences it entails, and how EORs provide a strategic solution to prevent it.

Key Takeaways

- Misclassifying workers can lead to lawsuits, fines, and back taxes.

- Employees are entitled to benefits that contractors aren’t.

- Remote and global teams increase misclassification risks.

- EORs help ensure proper worker classification and compliance.

- Partnering with an EOR supports safe, fast global expansion.

What Is Employee Misclassification?

Employee misclassification occurs when a company incorrectly labels a worker as an independent contractor instead of an employee. This misclassification can lead to significant legal and financial repercussions, including unpaid taxes, denied benefits, and potential lawsuits.

In the United States, the distinction between employees and independent contractors is crucial. Employees are entitled to benefits such as overtime pay, unemployment insurance, and workers’ compensation, while independent contractors are not.

Misclassification denies workers these protections and can result in hefty penalties for employers.

The Risks Of Misclassification

Employee misclassification is a significant concern for businesses, leading to severe legal and financial consequences.

Understanding these risks is crucial for businesses aiming to maintain compliance and protect their workforce.

Legal Penalties:

Misclassifying employees can lead to severe legal and financial consequences. A notable example is Arise Virtual Solutions, which faced multiple lawsuits for misclassifying workers as independent contractors.

In one high-profile settlement, Arise agreed to pay over $13 million to resolve claims, including $3 million in back wages to more than 22,000 customer service agents. This case underscores the serious risks of non-compliance, including unpaid wages, legal penalties, and long-term liabilities.

Reputational Damage:

Beyond financial penalties, misclassification can damage a company’s brand, erode employee trust, and attract negative media coverage. High-profile legal cases often become public, affecting future hiring, partnerships, and investor confidence.

Operational Disruptions:

Legal investigations and proceedings can significantly disrupt a company’s operations by diverting critical resources and attention away from core business activities.

Management and key personnel often need to dedicate substantial time and effort to address legal issues, which can detract from day-to-day operations and strategic initiatives. This diversion can lead to decreased productivity, delayed projects, and hindered business performance.

The financial burden of legal disputes, including attorney fees, court costs, and potential settlements, can strain a company’s finances, limiting funds available for essential operations and growth opportunities.

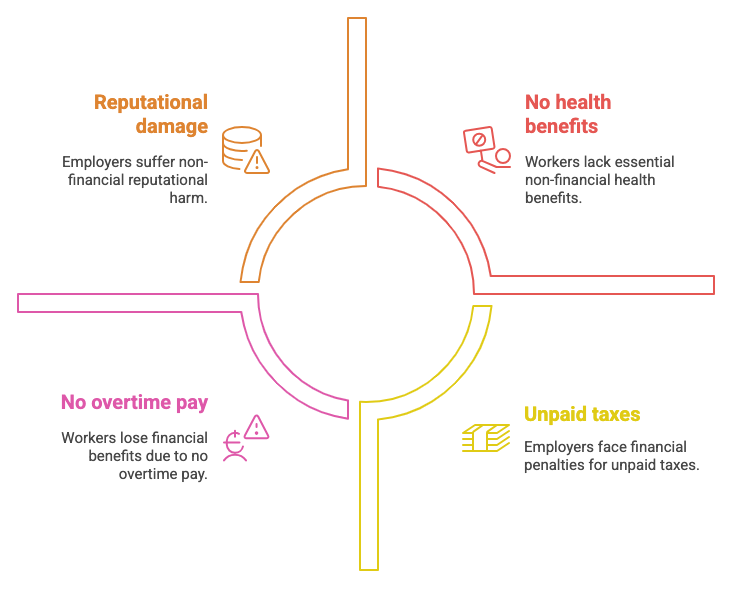

Consequences of Employee Misclassification

Understanding Employer Of Record (EOR)

An Employer of Record (EOR) is a third-party organization that becomes the legal employer of a company’s workforce. The EOR handles all employment-related responsibilities, including:

- Payroll Processing: EORs manage the entire payroll cycle, ensuring employees receive accurate, timely payments while adhering to tax and labor laws.

- Tax Compliance: They handle tax withholdings, filings, and payments, ensuring compliance with federal, state, and local tax regulations to avoid penalties.

- Benefits Administration: EORs oversee employee benefits programs, including health insurance and retirement plans, ensuring proper enrollment and regulatory compliance.

- Regulatory Compliance: They ensure adherence to employment laws and regulations, mitigating legal risks and maintaining ethical workforce management practices.

By assuming these responsibilities, EORs enable companies to focus on their core operations while mitigating employment-related risks.

How EORs Prevent Employee Misclassification

Employee misclassification can lead to significant legal and financial repercussions for businesses, especially when navigating complex international labor laws. Partnering with an Employer of Record (EOR) offers a strategic solution to ensure accurate worker classification and compliance across various jurisdictions.

Accurate Worker Classification

EORs bring deep, up‑to‑date expertise in local, national, and international labor laws, monitoring legislative changes and court rulings to maintain full compliance.

They meticulously review each worker’s role, contract terms, and work environment to determine the correct employment status, whether full‑time, part‑time, or independent contractor.

By establishing clear classification policies, detailed documentation, and consistent internal audits, EORs eliminate ambiguity and enforce uniform practices across all jurisdictions.

This structured approach not only prevents inadvertent misclassification but also shields companies from costly penalties, back‑tax liabilities, and reputational harm.

EORs provide audit support, handling inquiries and defending classification decisions—so your team can focus on strategic growth rather than compliance headaches.

Compliance with Local and International Laws

Operating across different jurisdictions requires adherence to varying employment laws. EORs stay updated on these regulations, ensuring that employment practices comply with local and international standards.

Moreover, they proactively monitor legislative changes, labor policies, taxation requirements, and social security mandates in each region, leveraging in‑country experts and direct liaison with authorities to adapt contracts, payroll, and benefits swiftly, thus minimizing compliance risks.

Streamlined Onboarding and Documentation

EORs initiate a comprehensive onboarding workflow, starting with initial consultations and needs assessments to define roles and draft legally compliant employment contracts and service agreements.

They meticulously collect and verify essential documentation, such as identification, work eligibility, and tax forms, ensuring accuracy and completeness before new hires begin. By setting up payroll accounts, benefits enrollment, and tax withholding configurations in line with local regulations, they eliminate classification errors that could trigger misclassification penalties.

EORs implement secure digital record‑keeping systems for all onboarding paperwork, enabling seamless audits and compliance reviews. Finally, through ongoing audits and timely updates to classification protocols, they ensure any regulatory changes are promptly reflected in contracts and processes.

Handling Taxation and Benefits

By meticulously handling tax withholdings, calculating contributions, filing payroll taxes on time, and keeping detailed records, EORs prevent classification errors, facilitate accurate remittances, and guarantee compliance with federal and local tax regulations.

Simultaneously, by administering benefits like health insurance, retirement plans, paid time off, and workers’ compensation, they ensure individuals receive entitlements aligned with their status, solidifying proper classification and reducing disputes over misapplied benefits.

Benefits Of Partnering With An EOR

Collaborating with an Employer of Record (EOR) streamlines the complexities of global employment. EORs handle administrative tasks, ensure compliance, and enable businesses to focus on their core operations while expanding internationally.

- Risk Mitigation: EORs possess in-depth knowledge of local employment regulations, significantly reducing the risk of non-compliance. By ensuring proper worker classification and adhering to tax laws, EORs help prevent legal disputes and financial penalties associated with misclassification and regulatory breaches.

- Operational Efficiency: Outsourcing HR functions to an EOR streamlines administrative processes such as payroll, benefits administration, and tax filings. This efficiency allows internal teams to concentrate on strategic initiatives, enhancing overall productivity and reducing the burden of managing complex HR tasks across multiple jurisdictions.

- Global Expansion: EORs enable rapid entry into new international markets by managing local employment requirements. They facilitate the hiring of talent in different countries without the need for the company to establish a local legal entity, thus accelerating global growth and reducing time-to-market.

- Cost Savings: Partnering with an EOR can lead to significant cost reductions by eliminating the expenses associated with setting up and maintaining foreign subsidiaries. Additionally, EORs often have established relationships with local vendors, potentially securing better rates for benefits and services.

- Compliance Assurance: EORs stay updated on the ever-changing landscape of international labor laws, ensuring that employment practices remain compliant. This vigilance protects companies from inadvertent violations that could result in fines or reputational damage.

- Simplified Payroll and Benefits Administration: Managing payroll and benefits across different countries can be complex due to varying regulations and standards. EORs handle these intricacies, ensuring that employees are compensated accurately and receive appropriate benefits, thereby enhancing employee satisfaction and retention.

- Focus on Core Business Activities: By entrusting employment responsibilities to an EOR, companies can allocate more resources and attention to their primary business objectives. This focus can lead to improved innovation, customer service, and competitive advantage in the marketplace.

Conclusion

Employee misclassification poses significant business risks, including legal penalties, financial liabilities, and reputational damage. Fines, back taxes, interest payments, and class-action settlements can cost companies millions, as seen in high-profile cases.

Regulatory investigations into misclassification also divert critical resources and management focus from strategic initiatives. An Employer of Record (EOR) provides a robust compliance framework by classifying workers according to jurisdictional labor laws.

EORs oversee payroll processing, tax withholdings, and benefits administration to guarantee proper employee entitlements. By handling administrative complexities, EORs minimize inadvertent misclassification and associated legal liabilities.

EOR services facilitate global expansion by enabling companies to hire in new markets without establishing local entities. Partnering with an EOR lets organizations focus on core operations, ensuring workforce compliance and driving sustainable growth.