Expanding your team globally offers exciting growth opportunities, but it also brings challenges, especially when it comes to compensating international employees with equity.

One common solution for hiring abroad is using an Employer of Record (EOR). But can you still offer stock options or RSUs through this model? The answer is nuanced.

In this article, we’ll unpack how equity compensation works with EORs, outline best practices, and help you avoid common pitfalls.

What Is an Employer Of Record (EOR)?

An Employer of Record (EOR) is a third-party organization that legally employs workers on behalf of another company.

This arrangement allows businesses to hire employees in countries where they lack a legal entity, with the EOR handling compliance, payroll, taxes, and benefits. While the EOR is the legal employer, the client company directs the employees’ day-to-day activities.

Key Functions of an EOR:

- Legal Employment: The EOR becomes the official employer in the eyes of the law, ensuring that employment contracts and practices comply with local regulations.

- Payroll and Tax Compliance: It manages payroll processing, tax withholding, and remittance, adhering to the specific requirements of each jurisdiction.

- Benefits Administration: The EOR provides statutory benefits and can offer additional perks, aligning with local standards and expectations.

- Regulatory Compliance: It ensures adherence to labor laws, including working hours, termination procedures, and other employment standards.

By partnering with an EOR, companies can expand their global workforce efficiently and compliantly, without the complexities of establishing foreign subsidiaries.

Can You Offer Equity Through An EOR?

Yes, you can offer equity to employees hired through an Employer of Record (EOR), but the process involves careful planning and adherence to local regulations.

While the EOR handles employment compliance, your company can directly grant equity to these employees, provided that the equity instruments are structured to comply with the laws of the employee’s country.

Key Considerations:

- Direct Equity Grants: The equity must be granted directly by your company, not the EOR, as EORs typically do not have the authority to issue equity on your behalf.

- Compliance with Local Laws: Each country has its own regulations regarding equity compensation. For instance, in some jurisdictions, certain types of equity awards may not be permissible or may have specific tax implications.

- Tax Implications: Equity compensation can have varying tax consequences depending on the country. It’s essential to understand and plan for these implications to avoid unexpected liabilities for both the company and the employee.

- EOR’s Role: While the EOR manages employment-related compliance, it may not be involved in the administration of equity compensation. Coordination between your company and the EOR is crucial to ensure that equity offerings are appropriately communicated and managed.

In summary, offering equity through an EOR is feasible but requires a thorough understanding of local laws, tax implications, and clear coordination between your company and the EOR.

Engaging legal and tax professionals familiar with international equity compensation is advisable to navigate this complex landscape effectively.

Types Of Equity Compensation Suitable For EOR Employees

Global employees can share in your company’s upside, but some equity vehicles are far easier to roll out under an Employer of Record (EOR) than others.

Instruments that keep administration with the parent company (or settle in cash) sidestep local securities filings, simplify tax withholding, and avoid placing fiduciary duties on the EOR.

Because the EOR is the legal employer, anything that requires the local entity to issue or hold actual shares can trigger extra corporate law steps, foreign exchange approvals, or securities-prospectus filings.

Cash-settled or parent-issued awards avoid most of those headaches and let you keep plan governance in one jurisdiction.

Below are the five instruments most often recommended for EOR hires, together with the reasons they work and the pitfalls to watch.

Equity Instruments for EOR Hires

Here’s a quick comparison of common equity instruments used for EOR employees, along with their pros, limitations, and considerations:

| Equity Type | Share-Settled / Cash-Settled | Parent Company Involvement | Employee Benefit | Complexity Level | Key Notes |

|---|---|---|---|---|---|

| NSOs | Share-settled | Issued by parent | Right to buy shares at strike price | Medium | Tax due on exercise; watch for Brazil, central bank rules |

| RSUs | Share or cash-settled | Issued by parent | Shares delivered post-vesting | Low–Medium | Tax at vesting; cash-settled safer in restricted markets like China |

| SARs | Often cash-settled | Issued by parent | Cash payout of share value growth | Medium | Avoids share transfer; may cause payroll spikes |

| Phantom Stock | Cash-settled | Issued by parent | Cash equivalent of stock value + dividends | Low–Medium | Bypasses ownership restrictions; needs cash reserves |

| ESPP / ESOP-Style Funds | Share-settled or cash-equivalent | Issued by parent | Discounted shares or retirement ownership | High | Varies by country; foreign brokerage limitations may apply |

1. Non-Qualified Stock Options (NSOs)

NSOs give employees the right to buy shares at a preset strike price. They can be granted to non-US employees and contractors, making them the most flexible true-equity vehicle.

Why do they suit EOR hires?

- Parent company issues the option; no share transfer happens until exercise, so local corporate formalities are deferred.

- Tax is usually due only when the option is exercised, allowing time to plan payroll withholding with the EOR.

Note: markets that tax unrealised spreads annually (e.g., Brazil) or require central-bank registrations for offshore share purchases.

2. Restricted Stock Units (RSUs)

RSUs promise a future share delivery once the vesting schedule is met, with no purchase price for the employee.

Why do they suit EOR hires?

- Simple communication—employees understand “shares later if you stay.”

- Tax and social charges are triggered at vesting, making payroll compliance straightforward for the EOR.

Note: jurisdictions (e.g., China) that limit foreign-listed share settlements; cash-settled “RSU-equivalents” may be safer there.

3. Stock Appreciation Rights (SARs)

SARs award the growth in share value over a base price, paid in cash or shares.

Why do they suit EOR hires?

- If cash-settled, no share ever crosses borders, eliminating securities-law filings

- Employees still feel aligned with company performance, as their payout rises with the stock price.

Note: Large cash settlements can create year-end payroll spikes that the EOR must fund upfront.

4. Phantom Stock

Phantom units mirror full-value shares and pay out the market price at vesting. They function like SARs but include dividends or dividend equivalents.

Why do they suit EOR hires?

- 100 % cash-based, so they bypass local share-ownership restrictions.

- Plans can be designed to match home-country RSU vesting, keeping equity culture consistent worldwide.

Note: ordinary-income taxation and the need to accrue cash on the parent’s balance sheet.

Employee Stock Purchase Plans (ESPPs) & ESOP-Style Funds

An ESPP lets employees buy shares, often via payroll deduction, at a discount. ESOP-style retirement plans offer ownership through a trust.

Why can they work?

- Many jurisdictions treat small-discount ESPP Purchases as simple wage income, which the EOR can withhold.

- Participation is optional, giving flexibility where currency-control rules complicate contributions.

Watch for: countries that forbid foreign brokerages or require local prospectuses. Consider a “non-qualified” ESPP variant with cash-settled credits in those markets.

Choosing The Right Mix

When you combine global hiring with equity incentives, balance three factors:

- Regulatory friction – favor cash-settled or parent-issued awards where share transfers trigger heavy filings.

- Employee perception – stock-settled awards often feel more tangible; use RSUs or NSOs where feasible.

- Cash impact – phantom plans and SARs shift market-risk cash costs to the company; budget for liquidity at vest and exercise.

Work closely with local counsel and your EOR partner to confirm withholding, reporting, and any foreign exchange approvals before making grants.

A carefully layered program, NSOs or RSUs where rules are clear, cash-settled SARs or phantom units where they’re not, lets you motivate global talent while staying compliant.

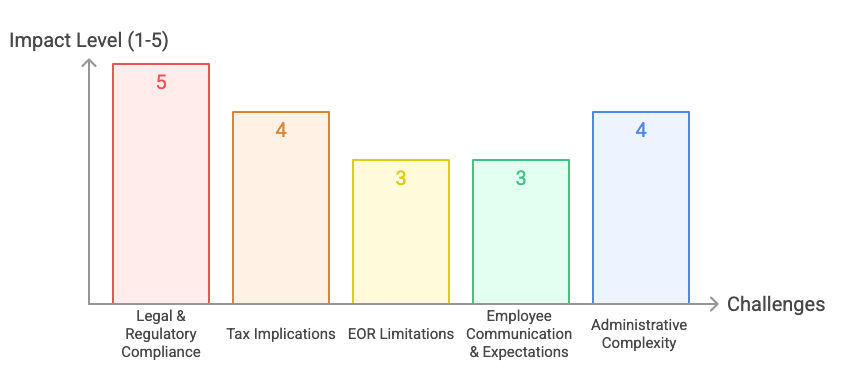

Challenges In Offering Equity Via An EOR

Offering equity to employees through an Employer of Record (EOR) can be a strategic move for global talent acquisition, but it comes with its own set of challenges. Here are some key considerations:

- Legal and Regulatory Compliance: Navigating diverse international laws complicates equity offerings; non-compliance risks significant legal and financial penalties.

- Tax Implications: Varying tax treatments across jurisdictions can lead to complex withholding obligations and unexpected liabilities.

- EOR Limitations: Not all EORs support equity compensation; some lack the infrastructure or expertise to manage such plans.

- Employee Communication and Expectations: Employees may misunderstand equity benefits; clear communication is essential to align expectations and satisfaction.

- Administrative Complexity: Managing equity across multiple countries increases administrative burdens, requiring meticulous tracking and compliance efforts.

While offering equity through an EOR is feasible, it requires careful planning and collaboration with experienced partners. Companies must navigate legal, tax, and administrative challenges to ensure compliance and achieve the desired outcomes for both the organization and its employees.

Top Challenges in Offering Equity via an EOR

Best Practices For Granting Equity Through An EOR

Here are the best practices for granting equity to employees through an Employer of Record (EOR), ensuring compliance and alignment with your company’s goals:

- Select the Appropriate Equity Instrument: Choose cash-settled options like SARs or Phantom Stock to simplify cross-border equity compliance.

- Ensure Direct Granting from the Parent Company: Issue equity directly from your company to avoid legal complications with the EOR structure.

- Understand and Comply with Local Tax and Legal Requirements: Consult local experts to navigate tax laws and ensure compliance with equity compensation regulations.

- Communicate Clearly with Employees: Provide transparent information on equity plans, including vesting schedules and potential tax implications.

- Coordinate with the EOR for Compliance and Reporting: Work closely with the EOR to manage reporting and withholding requirements for equity compensation.

- Regularly Review and Update Equity Plans: Periodically assess and adjust equity plans to remain compliant with evolving laws and regulations.

Frequently Asked Questions

Q1. Can I offer equity to all international employees through an EOR?

Not necessarily. The ability to offer equity depends on local laws and the EOR’s capabilities. It’s essential to assess each situation individually.

Q2. What are the tax implications for employees receiving equity via an EOR?

Tax implications vary by country and the type of equity offered. Employees may face income tax upon vesting or capital gains tax upon sale. Consulting with tax professionals is advisable.

Q3. Are there alternatives to traditional equity grants for EOR employees?

Yes. Instruments like SARs and phantom stock can provide similar benefits without the complexities of actual equity ownership, making them suitable alternatives in certain jurisdictions.

Conclusion

Offering equity through an Employer of Record (EOR) is a viable strategy for engaging and retaining global talent. However, it necessitates meticulous planning, a thorough understanding of local laws, and collaboration with experienced partners.

By adhering to best practices, such as selecting appropriate equity instruments, ensuring direct grants from the parent company, and maintaining clear communication with employees, companies can navigate the complexities involved.

It’s crucial to work closely with legal and tax experts to ensure compliance and to regularly review and update equity plans in response to evolving regulations. With careful execution, equity compensation via an EOR can align employee interests with company success across international borders.